Helping Canadians achieve their financial goals through unbiased expert insights

At Eckler, we believe that people and businesses everywhere deserve to secure and safeguard their future. While a good retirement plan is a key component, we believe in a broader vision and a more holistic approach.

With Guided Outcomes™, employees get the tools and insights they need to set, plan and achieve their financial goals. Employers get the analytics they need to make strategic decisions that support employee financial health and achieve organizational objectives.

Guided Outcomes™ journey for plan members

Financial wellness curriculum

Our Guided Outcomes™ curriculum is a modular, multi-channel solution of expertly selected tools and insights (workshops, webinars, articles, videos, workbooks, on-line learning, individual financial coaching, plan sponsor program analytics and reporting) to help employees set, plan, and achieve their financial goals.

Employers can choose from packaged “off-the-shelf” solutions as well as a-la-carte or fully customized solutions to meet their objectives.

The right retirement goal

Knowing your goal is the most important step in reaching it! Unfortunately, many Canadians struggle to know what the “right” retirement goal is for their personal situation. It’s a complex question, so many end up using shortcuts like old rules of thumb or an out-of-reach (and perhaps unnecessary) savings goal. This could lead to a retirement quite different than what they expected, with many sacrifices along the way. That’s why Canadian researcher Bonnie-Jeanne MacDonald created a new retirement goal – The Living Standard Replacement Rate (LSRR for short.) It’s a simpler and more accurate way for Canadians to set and achieve their retirement goals. Watch this video to learn more about LSRR and why you should use it!

Guided Outcomes™ for employers

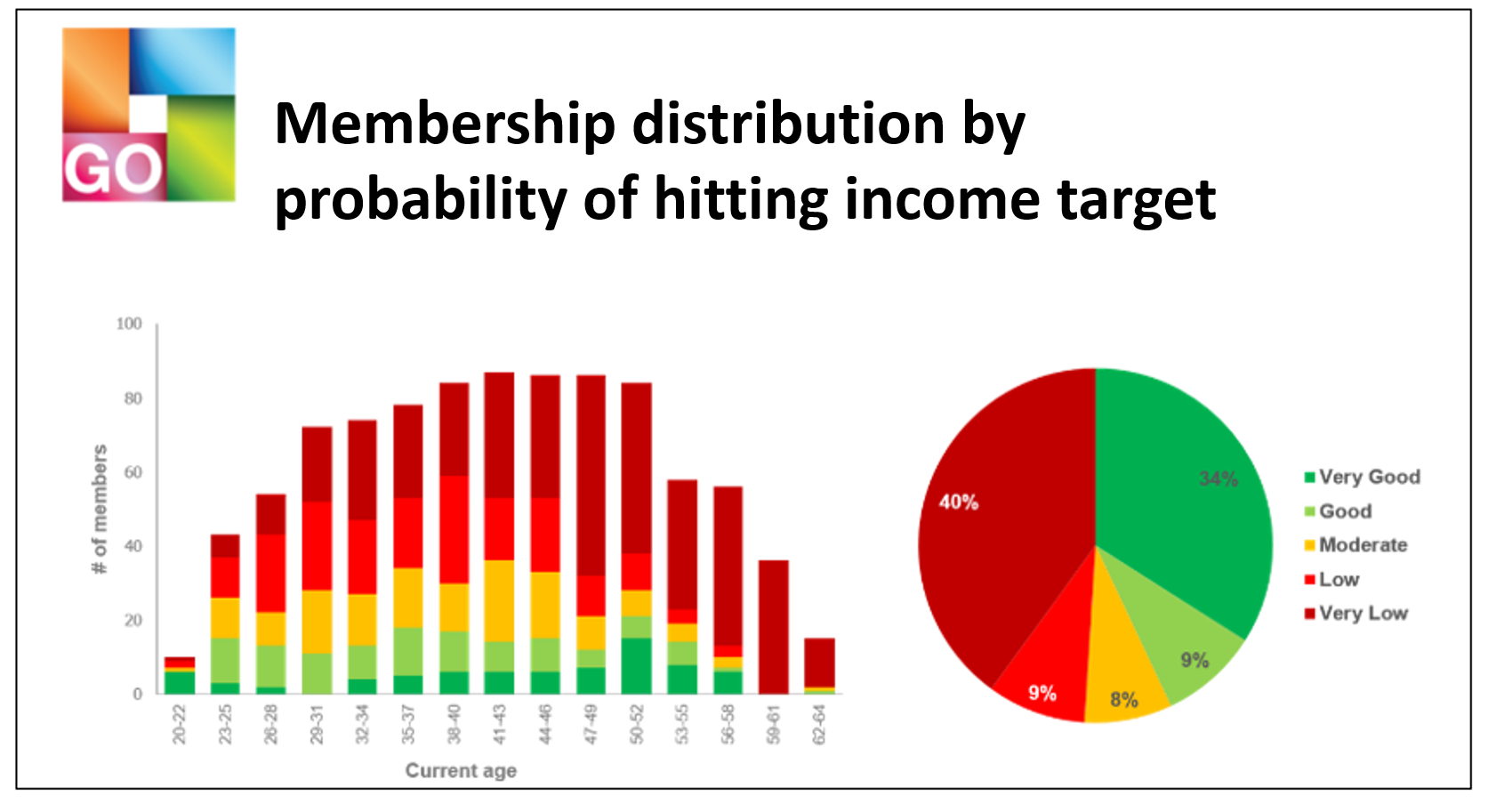

Retirement income adequacy is a growing concern for Canadians. It’s more important than ever to understand what your plan delivers so you can make sure your members get what they need from it. Guided Outcomes™ provides the analytics to assess, strategize and implement solutions so your workforce can achieve their retirement goals. By marrying your existing HR information and data from your plan administrator, we use sophisticated analytics using an award-winning economic scenario generator to illustrate the likelihood of your plan members achieving their personal Living Standard Replacement Rate. Detailed analysis (by salary levels, tenure, age, or division) gives you the critical information you need to make strategic decisions about which actions can help close the gaps for plan members while achieving your organizational objectives.

Retirement income adequacy is a growing concern for Canadians. It’s more important than ever to understand what your plan delivers so you can make sure your members get what they need from it. Guided Outcomes™ provides the analytics to assess, strategize and implement solutions so your workforce can achieve their retirement goals. By marrying your existing HR information and data from your plan administrator, we use sophisticated analytics using an award-winning economic scenario generator to illustrate the likelihood of your plan members achieving their personal Living Standard Replacement Rate. Detailed analysis (by salary levels, tenure, age, or division) gives you the critical information you need to make strategic decisions about which actions can help close the gaps for plan members while achieving your organizational objectives.

You can learn more about how Guided Outcomes™ can help you understand how well your plan is preparing your workforce for retirement in the video below.