Understanding the Quebec Drug Insurance Pooling Corporation terms and conditions

By Philippe Laplante and Anne-Marie Proulx

Insights – February 2021

All views expressed are the authors’ own and do not necessarily reflect the official position of any agency, organization, plan sponsor or company.

Background

High-cost drugs have always posed a significant risk for the financial health of group insurance plans. Without an appropriate risk-pooling mechanism to address this issue, many plans would be unable to bear the cost of claims.

Let’s imagine the case of a company with 50 employees providing full group insurance coverage, at an average annual cost of $4,000 per employee.

An employee is then diagnosed with a condition that requires the recurring purchase of a specialty drug costing $200,000 per year. Without pooling of catastrophic risks with other plans, the average cost required to insure this group could double, rising from $4,000 to $8,000 per employee. In all probability, this would make the plan unaffordable.

A pooling mechanism has been set up to prevent such situations from arising. Pooling allows high insurance costs to be spread over all private plans, rather than being borne by a single insurer or employer. Pooling can apply to drugs only, or more broadly can include all medical treatments. Also, claims incurred abroad, which can represent astronomical sums, are generally pooled on a separate basis.

In January 2013, all insurers in Canada set up a nationwide mechanism for pooling with regard to medications: the Extended Healthcare Policy Protection Plan (EP3). This mechanism applies only to fully insured groups. Each participating insurer must prove that it meets EP3 standards but has the flexibility to adapt certain aspects of the EP3 standard such as pricing, the pooling threshold, and the drug list.

The origins of the QDIPC

In Québec, as a replacement for the EP3 agreement, the Québec government’s Act respecting Prescription Drug Insurance requires that all insurers and administrators of private employee benefit plans (called “Participants”) pool drug-insurance risks for their members in Québec. As a result of this requirement, the Québec Drug Insurance Pooling Corporation (“QDIPC”) was set up in 1997.

The QDIPC is, therefore, a pooling system aimed at sharing catastrophic drug-cost risks between its Participants, made up – as of January 1, 2020 – of 18 insurance companies and 11 benefit plan administrators.

QDIPC terms and conditions

Each year, no later than November 1, the QDIPC publishes the terms and conditions applicable to the following year. The terms and conditions set out, according to the size of groups:

- The required pooling threshold (i.e., the maximum risk that a group can bear)

- The recommended pricing per insured certificate, known as the “annual factor”

For 2021, the following terms and conditions have been determined. They represent a significant rise in expected pooled claims over 2020:

| Size of group (number of certificates) |

Pooling threshold | Annual factor Individual status |

Annual factor Family status |

Variation compared with 2020 |

| Fewer than 25 | $8,000 | $251 | $691 | +18.9% |

| Between 25 and 49 | $16,500 | $165 | $455 | +20.7 % |

| Between 50 and 124 | $32,500 | $94 | $258 | +26.4 % |

| Between 125 and 249 | $47,500 | $68 | $187 | +31.2 % |

| Between 250 and 499 | $72,000 | $49 | $135 | +43.9 % |

| Between 500 and 999 | $95,000 | $40 | $111 | +49.1 % |

| Between 1,000 and 3,999 | $120,000 | $35 | $95 | +52.7 % |

| Between 4,000 and 5,999 | $300,000 | $16 | $44 | +43.7 % |

| 6,000 and over | Free market | Free market | Free market | N/A |

Notes:

- The size of a group is based on the number of certificates insured for healthcare across Canada. However, only residents of Québec are eligible for QDIPC pooling.

- The rules apply as soon as at least one certificate in a group corresponds to a member residing in Québec.

- No change from the pooling thresholds of 2020.

These terms and conditions are set in order to meet two main objectives:

- Plans sustainability: the pooling threshold limits the risk that a group can bear based on its size, the aim being to prevent catastrophic claims leading to an excessive burden for the group (the acceptable threshold for default is set at 5%). For example, for 2021, a group of less than 250 insured members is prohibited from having a pooling threshold above $47,500, since the QDIPC considers that this would result in too great a risk of default.

- Budgeting: the annual factors give Participants an excellent indication of expected catastrophic claims. Although this is not mandatory, the QDIPC strongly recommends that its Participants use these factors in pricing for the groups they insure.

Evolution of terms and conditions

Over the past three years, the average yearly increase of annual factors has been between 8% and 23% depending on the size of the group (over the past 10 years: between 6% and 35%).

This high rate of inflation is expected to continue. This is because several new expensive therapies are expected to come onto the market, particularly new medication to treat certain cancers as replacements for chemotherapy.

Some statistics

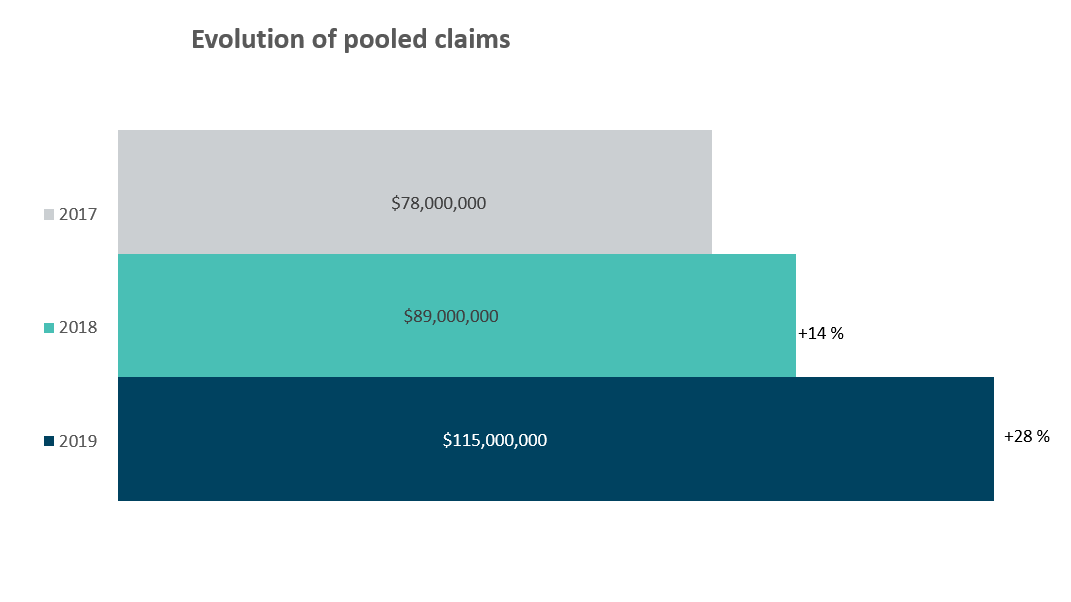

In 2019, pooled claims in Québec (i.e. per-certificate claims above pooling thresholds) represented approximately $115 million out of the $3.7 billion total claims on the private drug insurance market, that is, a 3% share.

Evolution of claims pooled by the QDIPC over the past three years:

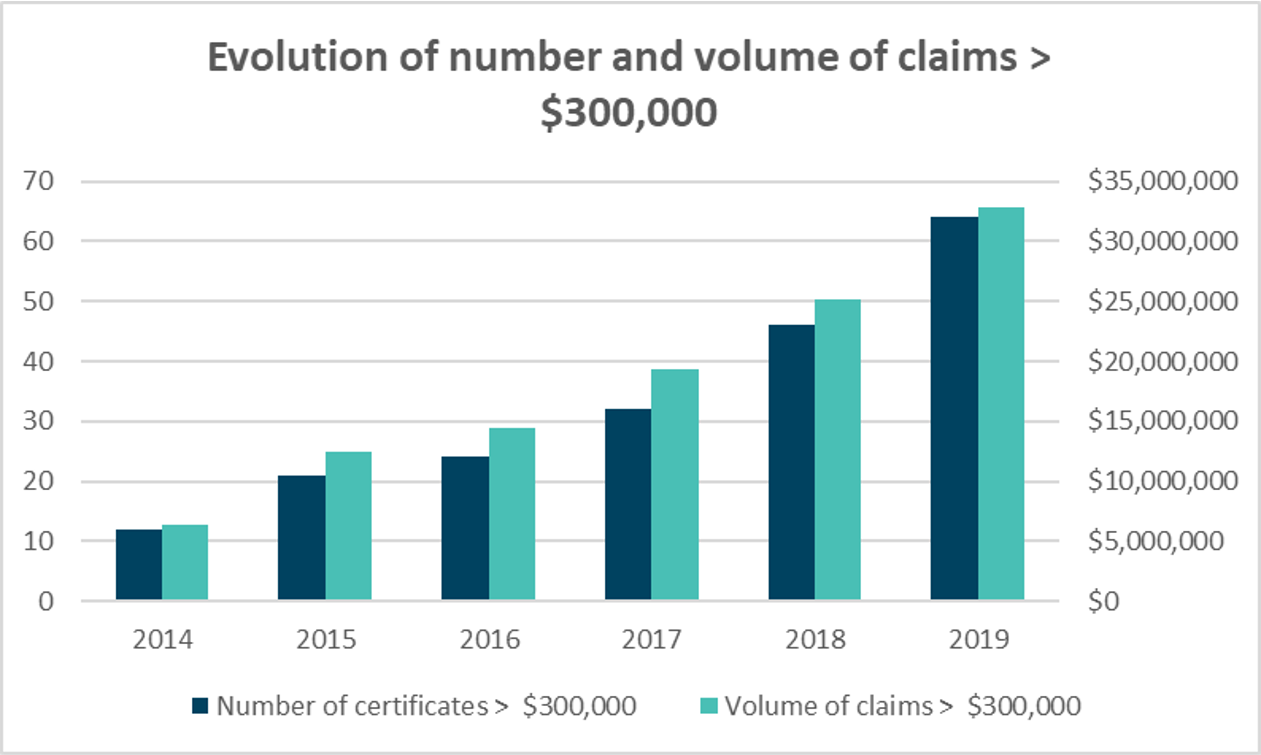

From 2014 to 2019 the number of certificates with claims exceeding $300,000 per year rose from 12 to 64, with the corresponding costs rising from $6.4 million to $32.8 million (a rise of over 500% in five years). These “catastrophic” certificates thus represent close to 30% of all pooled claims in 2019. The following graph illustrates this evolution:

Administration of the QDIPC

The QDIPC does not apply any adjustment on the basis of groups’ financial arrangements (i.e., fully insured, refund accounting, administrative services only) and covers all drugs reimbursed by Participants. Thus, drugs covered are not limited to the RAMQ list for private plans that offer a more exhaustive list of drugs.

The compensation method between Participants is as follows:

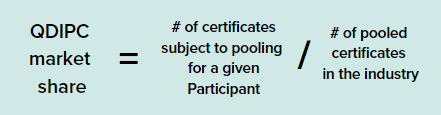

- The terms and conditions are used for theoretical and budgetary purposes only, and the amount ultimately paid by Participants in a given year will be exactly equal to claims exceeding the pooling threshold prorated on its market share using the following formulae:

The QDIPC’s operating costs are paid by Participants in a separate invoice, independently of pooled claims.

The example below demonstrates this functioning using three Participants with the following experience in 2019:

| Participant A | Participant B | Participant C | Total | |

| Market share | 20% | 30% | 50% | 100% |

| Claims exceeding the QDIPC threshold actually paid by the Participant | $100,000 | $125,000 | $150,000 | $375,000 |

| Participant’s pooled claims based on its QDIPC market share | 20% * $375,000 = $75,000 | 30% * $375,000 = $112,500 |

50% * $375,000 = $187,500 |

$ 375,000 |

| Reimbursement received from the QDIPC / Payment to the QDIPC | $25,000 reimbursement | $12,500 reimbursement | $37,500 payment |

The pooling process for Participant A would be as follows:

- In 2019: for all groups that it insures, Participant A pays for $100,000 in claims exceeding the QDIPC threshold.

- In 2020: QDIPC gathers data and performs calculations and verifications of pooling amounts.

- In January 2021: Participant A receives its reconciliation from the QDIPC, indicating that it will receive a $25,000 reimbursement for the 2019 year. Conversely, if an additional amount must be disbursed by Participant A, it will have a maximum period of 30 days to make the payment.

- In February 2021: Participant A receives its $25,000 reimbursement for the 2019 year.

What plan sponsors must check

At renewal of your group insurance plans, take the time to compare the pooling fees charged by your insurer with the QDIPC pooling cost for a pooling threshold similar to yours (that is, although you cannot have a pooling threshold higher than that of the QDIPC, you could further limit your risk and have a lower threshold). This check will give you a good understanding of the fees that are charged to you.

Potential discrepancies between your pooling costs and the QDIPC factors:

- QDIPC factors represent expected claims and therefore exclude premium taxes and applicable costs (commissions, administration, profit, etc.), unlike pooling costs under a private plan.

- However, the QDIPC includes a margin for unfavourable discrepancies of approximately 8%.

- The QDIPC applies solely to drug claims, while certain private plans include all healthcare claims in pooling.

- The QDIPC applies pooling thresholds per certificate, whereas some private plans are on a per-participant basis (a family certificate includes more than one participant, which can result in the pooling threshold being attained more quickly).

This issue of Insights has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this notice, please contact an Eckler consultant.