Rosy expectations may fuel retirements

Capital Accumulation Plan Income Tracker (CAPit) – August 2021

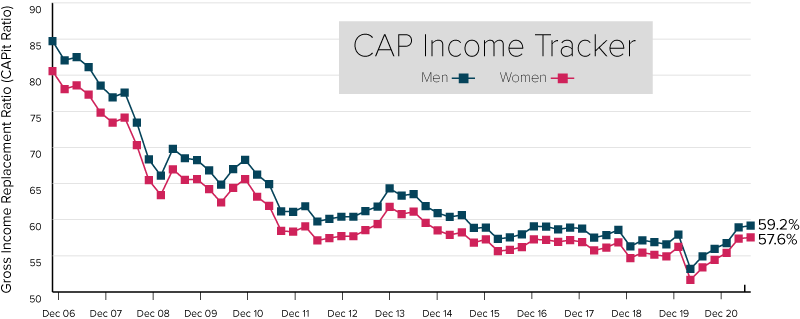

Rising equity markets during Q2 2021 shielded members from decreased annuity rates and improved member outcomes. A typical male DC plan member retiring at age 65 at the end of June, achieved a gross income replacement ratio of 59.2% and a female DC plan member 57.6% replacement.

The steep market downturn and recovery in 2020 has painted different retirement pictures for DC members who retired within 16 months of each other. Members who retired at the end of June this year received a 7% higher annual income for life compared to those who retired in March 2020.

After participating in the investment market rollercoaster ride of 2020, investor expectations have shifted considerably, and many are now looking for returns of 10.6% above inflation from their

investments in 20211. However, over the past 20 years, a balanced portfolio consisting of 60% in equities and 40% in bonds generated an annualized return of 6.6% while Eckler’s Long-Term Capital Market Assumptions project an average annual return of 5.1% over the next 20 years. If a typical DC member earned an annual return of 10.6% after inflation on their investments, they would be able to replace around 90% of their income at retirement!

The extreme market swings have not only biased investors’ expectations, they have also impacted their risk tolerance. Nearly three-quarters (71%) of investors in a recent survey conducted by Natixis Investment Managers recognize sudden market swings of 10% up or down as a normal occurrence and 69% agree that volatility can create opportunities to grow wealth.

At the beginning of the pandemic, we saw DC investors transferring their investments out of risk-seeking assets into low risk assets and they missed out on the market rebound. As behavioural

science has taught us, our most recent experiences influence our expectations for the future. While many decided to delay retirement during COVID, now that we have enjoyed tremendous market

gains over the past 15 months, will this positive outlook alleviate near-retirees fears of future returns and lead them to retire sooner? Have they become so comfortable with market swings that they are willing to endure them in retirement? Retirements were expected to increase coming out of COVID and these market expectations will likely help to fuel that change. Plan sponsors should be prepared for the impact on their workforce planning.

1 Natixis Investment Managers

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at age 40, will receive maximum Old Age Security and Canada/Quebec Pension Plan payments, and will use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $68,416 at June 30, 2021.

This issue of CAPit has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.