Rebounding CAP replacement rates not enough to provide most with comfortable retirement

Capital Accumulation Plan Income Tracker (CAPit) – October 2020

With three quarters of 2020 behind us, given the resurgence of COVID-19 cases and new lockdown measures that will continue to weigh on economies, uncertainty is likely to remain the theme for the rest of the year. The resilience of the equity markets following the sharp market contraction in the spring has helped push the recovery of retirement incomes toward pre-pandemic levels. A typical male DC plan member retiring at age 65 at the end of September saw their gross income replacement ratio returned to 56.0% from the all-time low of 53.1% in March. For a female DC plan member, the ratio increased to 54.5% from the all-time low of 51.6% at the end of March.

![]()

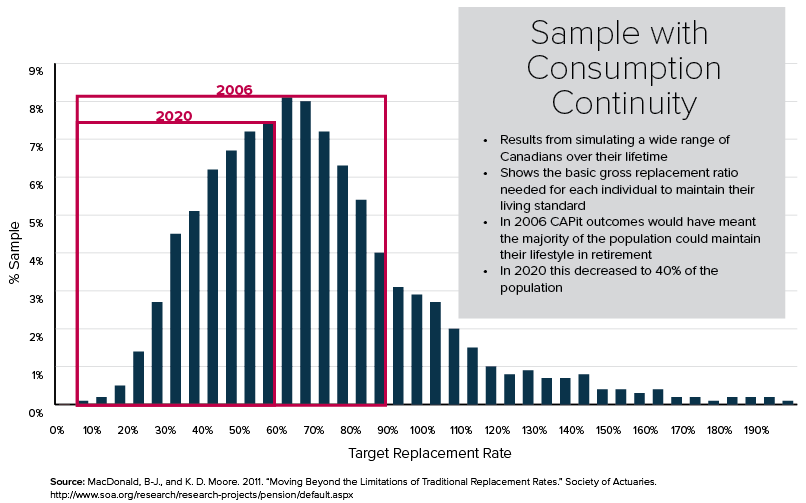

The gross income replacement ratio for a typical CAP member has been trending downward since we began tracking in 2006. Perhaps more importantly, however, this trend has also impacted the ability of CAP members to maintain their standard of living in retirement.

Through her research, Dr. Bonnie-Jeanne MacDonald revealed that the income replacement ratio needed for Canadians to maintain their living standard in retirement ranges considerably from 10% to 200% of gross pre-retirement income. An income replacement ratio of around 85% that could have been achieved by a typical plan member in 2006 would have been enough for most to maintain their standard of living in retirement. Today, an income replacement ratio of around 55% will only be enough for about 40% of typical plan members.

Dr. MacDonald’s work also proved that the universal rule of thumb that replacing 70% of pre-retirement income will lead to a comfortable retirement, was false. Plan sponsors should instead help members maintain their living standards in retirement by using the Living Standard Replacement Rate (LSRRTM). Given the waves of uncertainty in 2020 and possibly going forward, providing members with a savings target based on living standard continuity will help provide employees comfort on their current path to retirement or act as a trigger to revisit and revise their retirement plan.

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at age 40, will receive maximum Old Age Security and Canada/Quebec Pension Plan payments, and will use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $ 67,738 at September 30, 2020.

This issue of CAPit has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.