Pension de-risking in the current market

PRT Insights – June 2022

With inflation at levels not seen since 1991, three interest rate hikes from the Bank of Canada during the first half of 2022, and more expected, many are concerned about prospects for the Canadian economy. But could there be a silver lining for pension plans?

Short-term interest rates have increased from 0.2% at the beginning of 2022 to 1.5% in June. With more rate increases expected, long-term bond yields have risen from near 1.7% to around 3% over the same period – reaching a level not seen since 2014. The good news? Increases in long-term bond yields mean a reduction in the cost of insuring plan members’ pensions through the purchase of annuities. For a typical defined benefit (DB) pension plan, the cost has likely reduced by 10-15% since the beginning of the year.

Despite equity markets having lost significant ground so far in 2022, the fall in pension fund values may not have been as steep as the fall in plan liabilities on a solvency or wind-up basis. This means that an annuity purchase or other similar de-risking strategy may be within reach, allowing plan sponsors to reduce or remove pension risks from the balance sheet without as much, or any, additional funding being required.

While this good news is certainly a welcome respite for DB plans, given that the current situation can quickly reverse, a review of a pension plan’s short- and long-term investment strategy with a view to locking in any improvement in funded status may be worth exploring, in particular, if risk transfer is a priority in the near future. After a very busy 2021 in the pension risk transfer (“PRT”) market, many pension plan sponsors are indeed continuing to take active steps in this direction, and it is likely that insurer capacity may become constrained once again through the second half of the year.

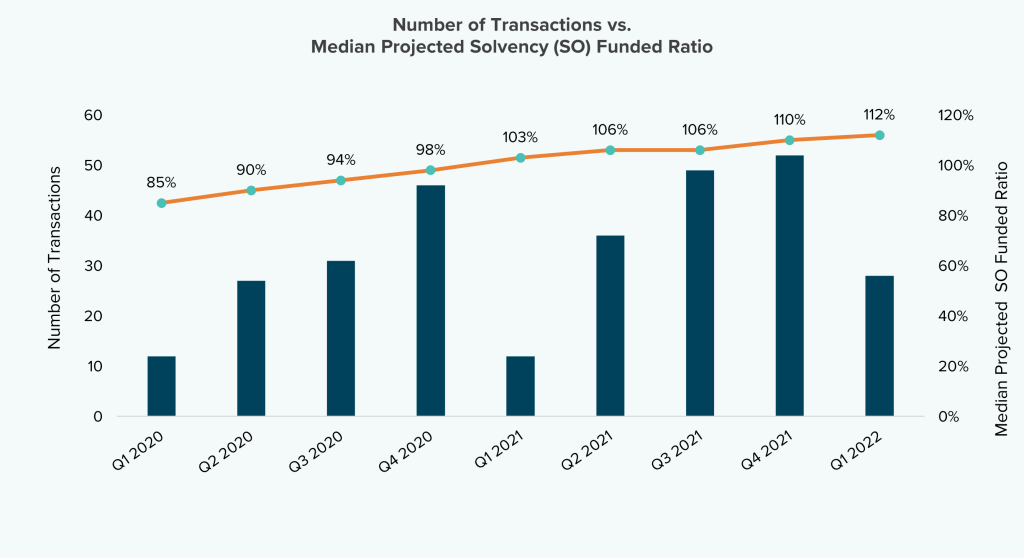

In fact, according to publications released by the Financial Services Regulatory Authority of Ontario (FSRA), data from the quarterly updates over the past two years on the estimated solvency funded status of DB plans in Ontario illustrate the positive correlation between the improved funded status for DB plans and the number of group annuity transactions in the PRT market.

Sources: FSRA Quarterly update on Estimated Solvency Funded Status of Defined Benefit Pension Plans in Ontario, for the period Q1 2020 to Q1 2022; Data collected directly from insurers

As the graph above illustrates, it is typical in the annuity market for there to be fewer annuity purchases in the first quarter of the year, building in more each quarter, through to year end. For Q1 2022, there has been twice the number of transactions compared to prior first quarters, which could signal a very busy year in 2022.

When it comes to purchasing annuities, being well prepared helps ensure the best possible price and a smooth transaction process. Below are a few early considerations that can help with that preparation:

- Is the next valuation date within six to eight months? There may be an opportunity to remove liabilities fully, or in-part, from the plan’s balance sheets ahead of the next report.

- Are benefits frozen? Have accruals stopped for active members? Annuity purchases can be a crucial step in the de-risking process.

- Where is the plan registered? Administrative discharge on annuity purchase is now an option for sponsors with plan members who accrued benefits in Ontario, British Columbia, Nova Scotia, Quebec and New Brunswick.

- Has a pensioner life audit been completed recently? Are there unlocated deferred vested members? A plan can save on premiums by performing a data clean-up and by removing unnecessary liabilities before purchasing annuities.

Knowing that the PRT insurer bid process can take several months, DB plan sponsors looking to transact in 2022 should consider initiating the process soon in order to make it into the insurers’ queues by year’s end.

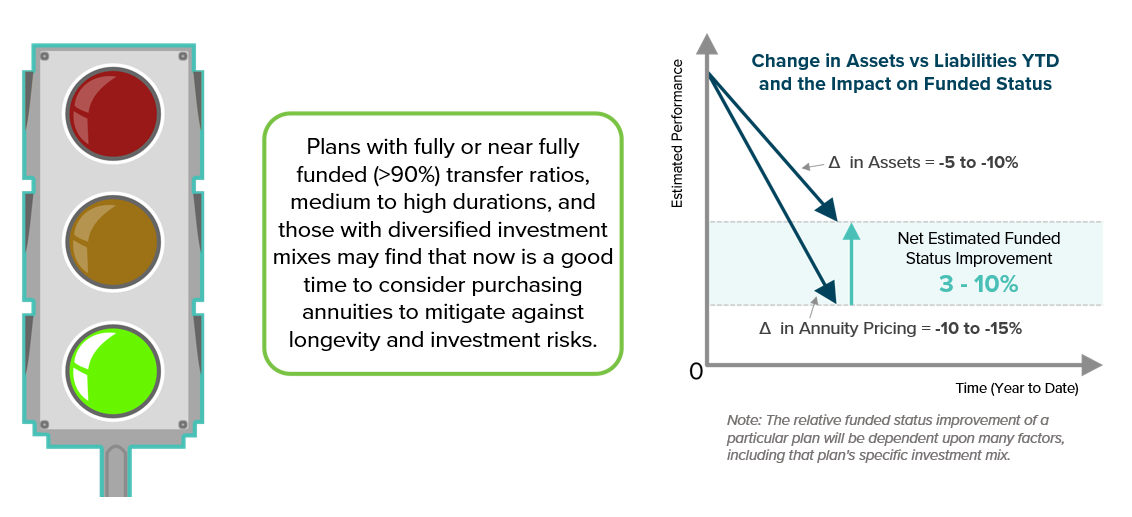

Our market indicator below shows that now may be a good time to consider pension de-risking action. To learn more about potential de-risking actions that are right for your plan, contact your Eckler consultant or reach out to us here.

Long-term bond yields were up 5bps during May and 124bps since the beginning of the year. More quantitative tightening is expected in the coming months to curb inflation, and higher yields should provide an opportunity for lower annuity pricing relative to the beginning of the year. At the same time, diversified portfolios have also seen a drop in assets, failing typically between 5-10% YTD.

Plan sponsors may be surprised to learn that the combined effect is that pension plan funded statuses may have improved by as much as 10% over the same period. As is typical, many insurers have had a slow first quarter – potentially allowing for more competitive pricing in the second and third quarters as insurance companies begin to bid more aggressively, especially those not near their annual sales targets.

Remember, when it comes to pension risk transfer, timing is important, but there are also many other considerations. It’s never too early to start a pension risk transfer conversation with your Eckler consultant to discuss the options available.

This article has been prepared for general information purposes only and does not constitute professional advice. The data presented herein is from third-party sources (primarily data collected directly from insurers) and Eckler has not independently verified, validated or audited the data. Eckler makes no representations or warranties with respect to the accuracy of the information. Nothing in this report should be construed as investment, legal or any other type of professional advice. Eckler is not responsible for the consequences of any use of the information presented in this report and does not accept any liability for errors, inaccuracies or omissions.