Keep an eye on target date investors

Capital Accumulation Plan Income Tracker (CAPit) – July 2020

Equity markets have bounced back significantly over the past three months, helping to offset the dramatic drop in interest rates and prop retirement incomes back up. A typical male DC plan member retiring at age 65 at the end of June saw their gross income replacement ratio increase to 54.5% from the all-time low of 53.1% in March. For a female DC plan member, the ratio increased to 53.0% from the all-time low of 51.6% last quarter.

![]()

It’s common for members to feel overwhelmed during times of significant market fluctuations. In fact, as we have seen during the pandemic, even members invested in target date funds are not immune to an emotional response to the markets. It’s critical that plan members not overreact, as making a decision in a moment of panic could cause additional and longer-term negative impacts.

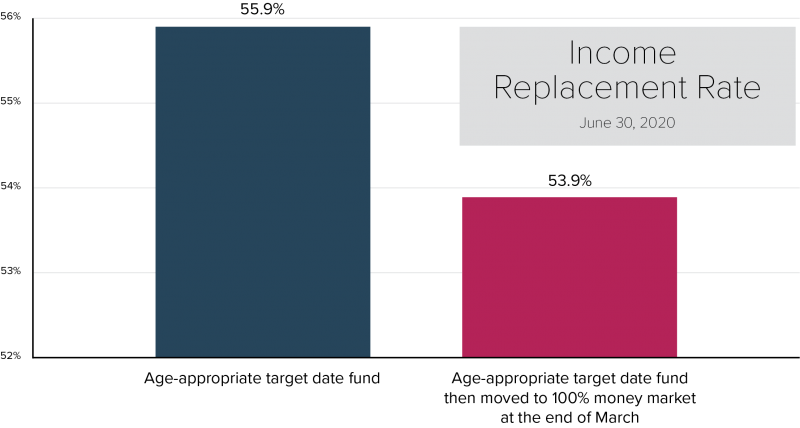

For example, a member on the cusp of retirement, fearing market swings, who moved from a 2020 fund to money market at the end of March would have locked in a 2% reduction in income for life.

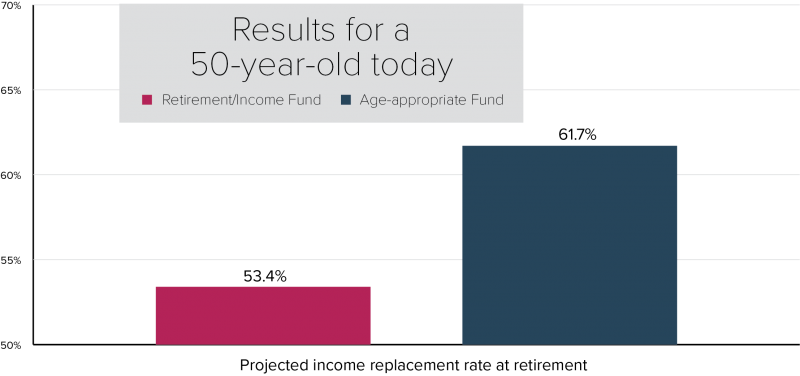

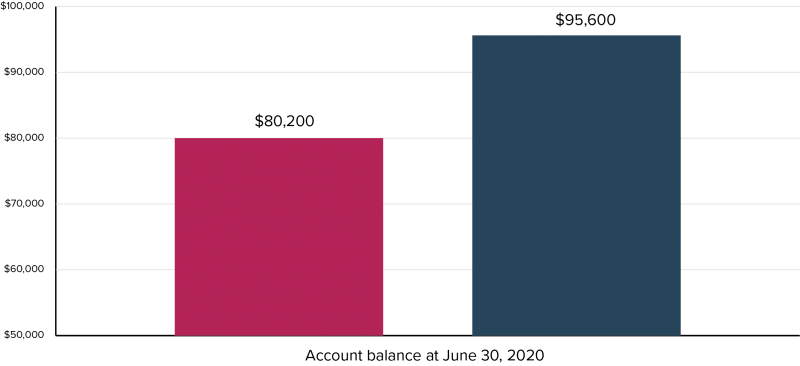

In addition to the member behaviour driven by the recent market fluctuations, we continue to note that many members are still not invested in the age-appropriate target date fund. The most common behavioural mistake we see is members investing in the ‘retirement’ fund when they are many years (sometimes 30 or more) away from retirement. The table below illustrates the impact of this mistake on the outcomes of a 50-year-old. Investing in the retirement fund earlier in their career has reduced this member’s current balance by $15,000, and cumulatively by age 65, will have reduced their replacement income by 8% for life.

As a plan sponsor, helping your DC members align their retirement objectives with the appropriate investment choices can have a significant impact on their outcomes – and, if members delay retirement because they can’t afford it, your workforce planning as well. As we enter into our collective “new normal”, finding ways to engage and educate your DC plan members has become increasingly important.

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at age 40, will receive maximum Old Age Security and Canada/Quebec Pension Plan payments, and will use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $67,738 at June 30, 2020.

This issue of CAPit has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.