After 11 years of bull markets…

Capital Accumulation Plan Income Tracker (CAPit) – February 2020

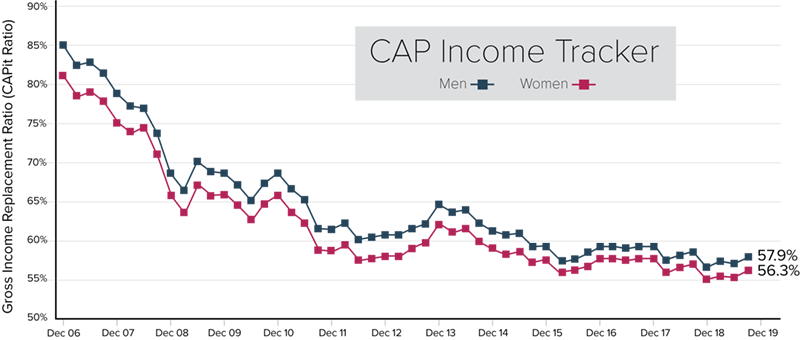

Strong stock returns in the last quarter have resulted in double-digit returns across all major equity markets in 2019. Although bond returns were weaker in the fourth quarter, the year still ended strong at 6% or higher across the Canadian bond market. The strong (bull) market returns have helped to improve the gross replacement rate of a typical male CAP member from 56% to 58% over the past year. For a female CAP member, the gross replacement rate increased less, from 55% to 56%. Slightly offsetting the equity gains were decreases in interest rates which reduces the income CAP members can expect when converting their balances into an income.

What might surprise you is that we have seen replacement rates decrease by over 10% during this 11-year bull market. So, even consistently strong equity market returns aren’t enough to help members improve the amount of income they can expect in retirement. In addition, persistently low interest rates, and increased longevity, are offsetting the positive impact from the bull market.

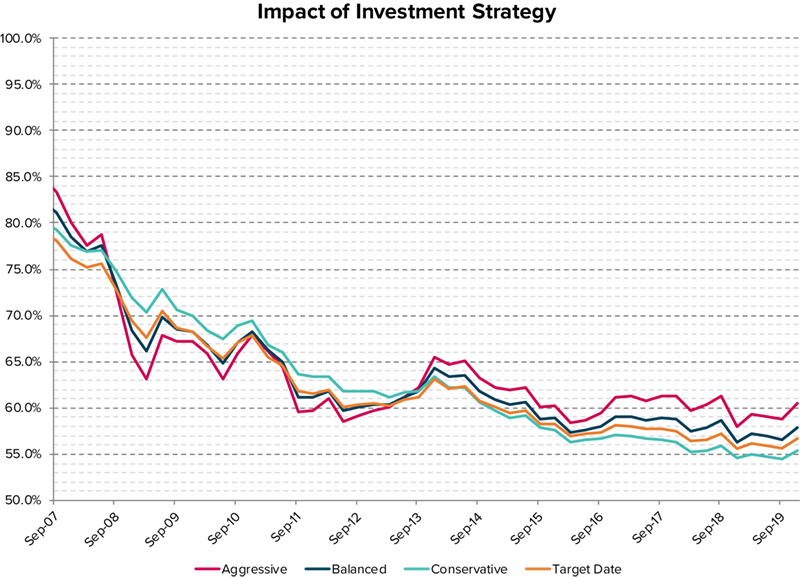

While the reduction in replacement rates has been felt across all investment strategies, being invested in an aggressive investment strategy (80% allocation to equities) delivered the best outcomes, delivering a gross replacement rate that was 5% higher than a conservative investment strategy (30% allocation to equities) over the same time period.

Looking forward, more member support and communications will have to be done to help members’ replacement rates stabilize and potentially increase. We can’t solely rely on market returns to get plan members to an adequate standard of living. Instead, plan sponsors will have to monitor member outcomes, then put strategies in place to enable their plan members to recognize the factors that are within their control – whether or not they participate in company-sponsored programs, how much they contribute to these programs, how much they need to save outside of the company offering and the age at which they choose to retire – and take appropriate action to help ensure a better outcome.

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at age 40, will receive maximum Old Age Security and Canada/Quebec Pension Plan payments, and will use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $66,691 at December 31, 2019.

This issue of CAPit has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.