GroupNews – August 2021

Eckler’s GroupNews monthly newsletter provides commentary on the issues affecting Canadian group benefit plans.

In this edition:

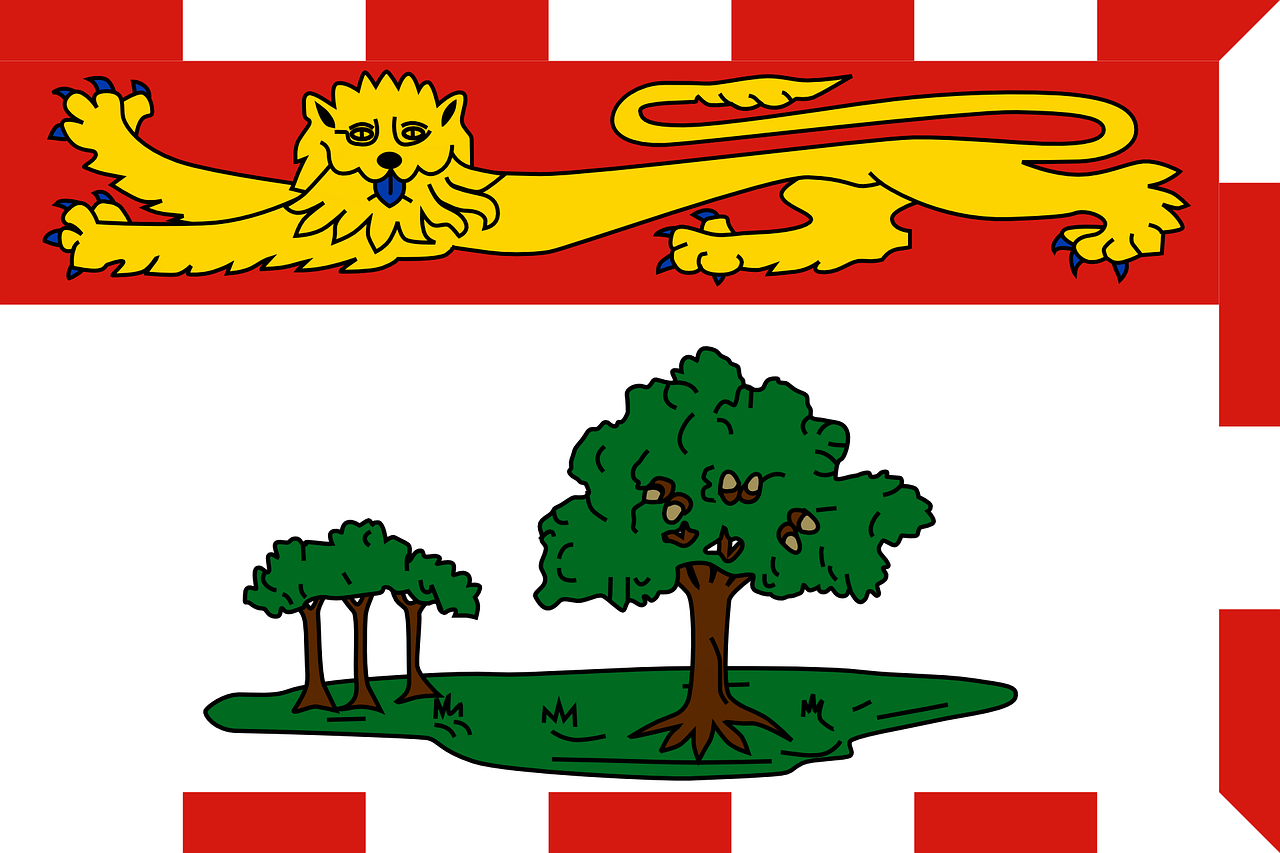

- Governments of Canada and Prince Edward Island announce agreement to accelerate implementation of pharmacare

- New Provincial Dental Care Program in Prince Edward Island

- Department of Health announces intention to amend Food and Drug Regulations and Medical Devices Regulations to support regulatory agility

- CRA interpretation on whether cost of COVID-19 test and vaccine qualify as taxable medical expense

- A look at how substance-related harms have changed during the pandemic

Benefit plan management

Governments of Canada and Prince Edward Island announce agreement to accelerate implementation of pharmacare

On August 11, 2021, the governments of Canada and Prince Edward Island announced an agreement intended to help accelerate the implementation of national universal pharmacare. Under the agreement, Prince Edward Island will receive $35 million in federal funding over four years to add new drugs to its list of covered drugs and lower out-of-pocket costs for drugs covered under existing provincial plans.

On August 11, 2021, the governments of Canada and Prince Edward Island announced an agreement intended to help accelerate the implementation of national universal pharmacare. Under the agreement, Prince Edward Island will receive $35 million in federal funding over four years to add new drugs to its list of covered drugs and lower out-of-pocket costs for drugs covered under existing provincial plans.

Prince Edward Island’s current public drug plans offer less comprehensive coverage than other Canadian jurisdictions and charge some of Canada’s highest co-pays and deductibles. The partnership with the federal government is intended to improve access to drugs and help residents of the province with the high costs of medications.

Impact: The federal government intends to use the agreement with Prince Edward Island to inform its own work toward a national pharmacare strategy. The agreement is intended to improve access and lower costs for prescription drugs in the province and make drugs more accessible for residents with rare diseases.

Benefit plan management

New Provincial Dental Care Program in Prince Edward Island

Prince Edward Island has launched a new Provincial Dental Care Program. First announced in the 2020 provincial budget, the program provides financial assistance to low-income Islanders and seniors for dental services including annual and emergency dental examinations, dental fillings, limited root canal treatment, dental extractions, limited preventative services, and dentures.

Prince Edward Island has launched a new Provincial Dental Care Program. First announced in the 2020 provincial budget, the program provides financial assistance to low-income Islanders and seniors for dental services including annual and emergency dental examinations, dental fillings, limited root canal treatment, dental extractions, limited preventative services, and dentures.

Financial assistance is dependent on income and family size and ranges from 100% coverage for an individual income of less than $22,014 to 20% coverage for a family of five with income of $68,914 or less.

Impact: This change is expected to have minimal impact on plan sponsors, as Prince Edward Island Health is the payor of last resort. If a partial benefit is paid by private insurance for a service under the Provincial Dental Care Program, the remaining costs are eligible to be paid under the Program.

Legal and legislative news

Department of Health announces intention to amend Food and Drug Regulations and Medical Devices Regulations to support regulatory agility

The federal Department of Health has announced plans to amend Canada’s Food and Drug Regulations and Medical Devices Regulations in spring 2022.

The amendments are designed to modernize the Canadian therapeutic product regulatory system by granting the Minister of Health the ability to impose terms and conditions on drug and medical device authorizations and expand the use of rolling submissions such as those currently in use for COVID-19 drugs. It would also modernize requirements for biologic drugs to reflect current safety practices.

The proposed amendments include:

- Extending the Minister of Health’s authority to impose terms and conditions on drugs and medical devices;

- Creating an optional pathway to facilitate timely access to drugs that address significant new and emerging diseases through a rolling submissions process; and

- Modernizing requirements for biologic drugs, including controls over manufacturing, standards, labelling, and lot releases.

The Minister of Health welcomes comments from interested stakeholders on the proposed amendments until October 28, 2021.

Impact: The proposed amendments are part of Health Canada’s Regulatory Innovation Agenda, which is intended to “support the reduction of regulatory irritants and roadblocks to innovation by making Canada’s science-based regulatory system more agile and internationally aligned.” The amendments are intended to improve access to innovative drugs, allow healthcare practitioners to prescribe a greater range of products, and help accelerate the access to drugs through more flexible submission requirements.

Legal and legislative news

CRA interpretation on whether cost of COVID-19 test and vaccine qualify as taxable medical expense

The Canada Revenue Agency (CRA) has issued a technical interpretation on whether the costs of COVID-19 tests required for travel to enter Canada and COVID-19 vaccinations received outside of Canada qualify for the purposes of the Medical Expenses Tax Credit (METC). The technical interpretation also contemplates whether COVID-19 tests and vaccines that are not eligible for the METC can be considered medical expenses, or connected expenses, for the purposes of determining whether an extended health plan meets the requirements to be a Private Health Services Plan (PHSP).

The Canada Revenue Agency (CRA) has issued a technical interpretation on whether the costs of COVID-19 tests required for travel to enter Canada and COVID-19 vaccinations received outside of Canada qualify for the purposes of the Medical Expenses Tax Credit (METC). The technical interpretation also contemplates whether COVID-19 tests and vaccines that are not eligible for the METC can be considered medical expenses, or connected expenses, for the purposes of determining whether an extended health plan meets the requirements to be a Private Health Services Plan (PHSP).

The CRA notes that pursuant to paragraph 118. 3(o) of the Income Tax Act (ITA), eligible medical expenses can include amounts paid for laboratory or other diagnostic procedures “for maintaining health, preventing disease or assisting in the diagnosis or treatment of any injury, illness or disability” if they are prescribed by a medical practitioner (which includes medical doctors, nurses or pharmacists). It is the CRA’s view that amounts paid for a COVID-19 test would qualify for the METC if all the requirements under the Income Tax Act were met.

Additionally, the CRA notes that amounts paid for a COVID-19 vaccine may qualify for the METC provided the drugs meet certain requirements under the ITA and Regulations related to manufacturing, treatment and prevention of disease and are prescribed by a medical practitioner.

Impact: While this CRA technical interpretation provides general comments about the provisions of the Income Tax Act, it does not confirm the income tax treatment of COVID-19 tests or vaccines officially. It offers the opinion that based on the criteria, COVID-19 tests and vaccines may qualify for the METC, but the opinion can only be confirmed by the CRA in the context of an advance income tax ruling request for a specific plan sponsor. However, the opinion expressed does offer plan administrators and members some hope that expenses related to COVID-19 can qualify for the METC if submitted.

Research

A look at how substance-related harms have changed during the pandemic

An analysis from the Canadian Institute for Health Information looks at the wider impact of COVID-19 by reviewing how substance-related harms such as alcohol, opioids, cannabis and other stimulants and depressants have changed across the country during the pandemic.

An analysis from the Canadian Institute for Health Information looks at the wider impact of COVID-19 by reviewing how substance-related harms such as alcohol, opioids, cannabis and other stimulants and depressants have changed across the country during the pandemic.

The report, Unintended Consequences of COVID-19: Impact on Harms Caused by Substance Use, compares emergency department and hospital data from March to September 2020 to the same period in 2019. Below are the highlights of the report.

- There were 80,954 substance-related inpatient hospitalizations between March and September 2020, representing a 5% increase from the same period in 2019. During the same period emergency department visits for harm caused by substance use declined by 5% to 176,902 in 2020.

- The total number of all substance-related deaths increased by 12% in emergency departments and by 13% in inpatient settings when compared to the same period in 2019. Over two-thirds of these deaths were attributed to opioid poisoning.

- Manitoba experienced the largest increase in total hospitalizations due to substance harm from 2019 at 16% – well above the 5% national average, in total hospitalizations due to substance harm from 2019.

- The most common substance noted in both substance-related emergency department visits and hospitalizations was alcohol, followed by opioids, then cannabis and stimulants.

- Males and those in the lowest-income areas saw the highest increases in substance-related harm. Men made 66% of all substance-related emergency department visits, 64% of all substance-related hospitalizations, and 79% of all substance-related in emergency department deaths. One third of all hospitalizations for substance-related harms were made by individuals in the lowest income areas.

Impact: Given the likelihood that many people who use substances may not visit hospitals during the pandemic due to the fear of contracting COVID-19, this analysis is likely only the tip of the iceberg as it relates to substance-related harms. Increased substance use during the pandemic may result in long-term health-related issues affecting employee absenteeism and productivity and potentially increasing costs for employer healthcare and disability plans.

This publication has been prepared by the GroupNews editorial board for general information and does not constitute professional advice. The information contained herein is based on currently available sources and analysis. The data used may be from third-party sources that Eckler has not independently verified, validated, or audited. They make no representations or warranties with respect to the accuracy of the information, nor whether it is suitable for the purposes to which it is put by users. The information is not intended to be taken as advice with respect to any individual situation and cannot be relied upon as such.

Current editorial board members are: Andrew Tsoi-A-Sue, Ellen Whelan, Charlene Milton, Philippe Laplante, and Nick Gubbay.