British Columbia Guidelines on PfADs for Target Benefit Provisions

Special Notice – January 12, 2023

As reported in our Special Notice of October 14, 2022, British Columbia has announced a major overhaul of the Provision for Adverse Deviation (PfAD) applicable to target benefit plans (TBPs).

The new definition consists of two components:

- A fixed minimum PfAD of 7.5%;

- An additional PfAD, or “supplementary percentage,” to be determined by the plan administrator (e.g. the board of trustees).

The BC Financial Services Authority (BCFSA) has now released guidelines setting out their expectations for the development and documentation of the PfAD. The Superintendent expects that plan funding policies as well as all actuarial valuation reports filed with a review date on or after December 31, 2022, will reflect the new PfAD definition. Furthermore, administrators are expected to file a copy of the funding policy with the valuation report. The PfAD, as one of the components of the actuarial valuation report, must be satisfactory to the Superintendent.

Legislative requirements

Under the BC Pension Benefits Standards Act and Regulations, the administrator of a plan with a target benefit provision must ensure that:

- The contractually required contributions of participating employers are sufficient to cover the plan’s normal actuarial cost plus PfAD, as well as any unfunded liability payments;

- Accrued benefits may not be improved unless the PfAD, as applied to the going concern liabilities, is fully funded and remains so immediately following the benefit improvement.

The guidelines clarify that the administrator may determine that a different supplementary percentage applies to (1) and (2) above.

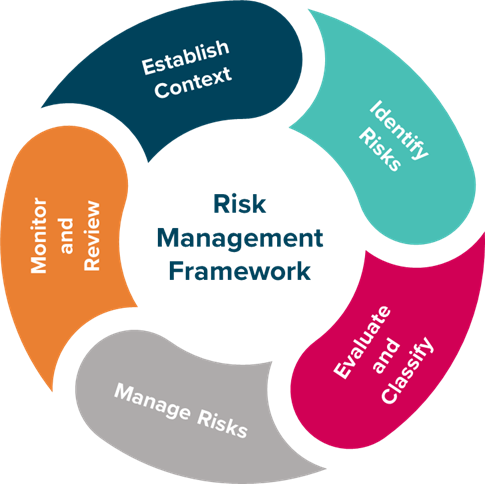

Risk framework

The guidelines describe specific steps for documenting a plan’s risk management framework. By having a robust system for identifying and assessing relevant risks, administrators are better positioned to develop risk mitigation strategies, including the identification of an appropriate PfAD, and to determine strategies outlining how plans will respond to adverse events and experience. These steps are relevant to all TBPs regardless of size. However, the Superintendent will use the principle of proportionality in assessing a PfAD, considering the nature, size, complexity, and risk profile of the plan.

The risk management framework generally includes the following five steps:

Establish context:

- Identify the plan objectives, including expected outcomes and priorities e.g. benefit adequacy, benefit stability, benefit security and/or generational equity.

- Describe the key plan financial metric(s), which may differ for accrued benefits and future benefit accruals in line with plan objectives.

- Utilize these objectives in the communications plan to members.

Identify risks:

Identify risks that could affect the plan’s ability to achieve the stated objectives and that could potentially be addressed by a PfAD. Generally, the following should be considered, along with any others relevant to the plan:

- Changes to the actuarial assumptions since the benefit rates were set;

- Adverse plan experience from economic and demographic factors compared to that expected in the actuarial valuation assumptions;

- Material changes to the composition of plan membership;

- Any asset or liability mismatch in the plan’s investment policy;

- Any industry-specific risk such as a significant decline in new members or hours worked;

- Sponsor or participating employers’ risk such as the failure or withdrawal of a sponsor, or one or more participating employers.

Evaluate and classify risks:

- Evaluate the identified risks, adopt processes to determine the degree of impact those risks could have on the plan’s objectives, and rank the risks in relation to the impact. This assessment could involve strategies such as stress testing and/or deterministic or stochastic sustainability testing.

- Classify the risks either individually or collectively within categories e.g. risk reduction, risk transfer, risk retention, risk acceptance.

Manage risks:

Establish appropriate risk management strategies in accordance with the risk classification. These strategies could include the following:

- Establish a PfAD which: a) may be fixed or variable depending on certain factors, b) may or may not be different when applied to normal actuarial cost and going concern liabilities;

- Time the filing of actuarial valuations so the plan is not adversely affected by significant experience losses over a short period of time;

- Establish actuarial asset-smoothing methods to help reduce short-term volatility of asset returns;

- Include additional margins in the valuation such as the excess of contributions above the cost of future benefits and expenses;

- Make benefit adjustments (e.g., indexing of pensions in payment or accrued benefits) contingent upon the plan achieving or maintaining certain quantifiable metrics;

- Amortize deficits over periods of time, ensuring minimum requirements are met.

Monitor and review:

- Set a monitoring and review frequency, as risk management should be an ongoing process.

Documentation of PfAD

The funding policy should document the rationale and method for identifying the PfAD.

- Rationale: The PfAD must reasonably follow from the plan’s stated objectives, risks, and other plan-specific considerations. There should be a sound explanation of how these factors lead to the intended method for identifying the PfAD.

- Method: In establishing risk management strategies, administrators must explain the process that identifies the PfAD. Examples of the method or approach include, but are not limited to:

i. A fixed PfAD;

ii. A quantitative method or approach where the PfAD may vary;

iii. A qualitative approach that explains the decision-making process for determining the PfAD.

Next steps: The BCFSA guidelines give plan administrators a great deal of flexibility in setting their supplementary PfAD. We expect to see a range of different approaches, reflecting each individual plan’s circumstances. However, it remains to be seen which approaches will be acceptable to the regulator. Plans with a target benefit provision should review their funding policy in conjunction with their actuary to ensure the plan administrator has developed and documented PfADs in line with the BCFSA guidelines.

The new PfAD applies to actuarial valuation reports filed with a review date on or after December 31, 2022. Where the plan’s next valuation date is after 2022, plan administrators may want to conduct a funding policy review in 2023 to identify their risks well in advance of the next valuation and address risk management strategies related to filing earlier valuations.

This issue of Special Notice has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.