Canadian salary increases will drop to 3.3% for 2026

Eckler’s survey reveals Canadian salary increases will drop to 3.3% for 2026 as employers navigate economic uncertainty.

TORONTO, CA, October 16, 2025—Canadian organizations are planning average base salary increases1 of 3.3% in 2026, according to Eckler’s latest compensation eplanning survey (excluding salary freezes). This is slightly below the actual increase of 3.4% in 2025, signalling a more cautious approach to budget planning amid slowing economic conditions and stabilizing inflation. While the Bank of Canada is cutting interest rates to ease borrowing costs and stimulate growth, rising unemployment and ongoing uncertainty are keeping employers conservative. At the same time, soaring housing costs and persistent inflation continue to exert upward pressure on wages.

“Employers are signalling that while the economy has cooled, the war for talent is not quite over,” said Anand Parsan, Principal at Eckler. “Only 5% of employers are considering salary freezes, and while 29% remain undecided, most are planning similar or lower salary increases compared to 2025. Trade tensions between Canada and the U.S. are also contributing to financial uncertainty, prompting employers to balance cost control with the need to reward and retain key talent.”

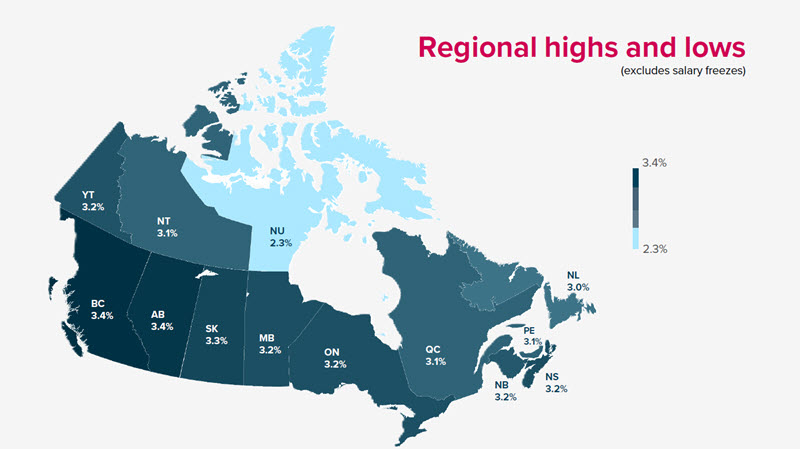

Regional highlights:

The West leads in wage growth, while Atlantic provinces, Quebec, and the northern territories lag behind.

- Highest increases: Alberta and British Columbia (3.4%), followed by Saskatchewan (3.3%).

- Moderate increases: Ontario, Manitoba, New Brunswick, Nova Scotia, and Yukon (3.2%)

- Below average increases: Quebec, Prince Edward Island and Northwest Territories, are anticipating increases that are below the national weighted average (3.1%)

- Lowest increases: Newfoundland & Labrador (3.0%) and Nunavut (2.3%)

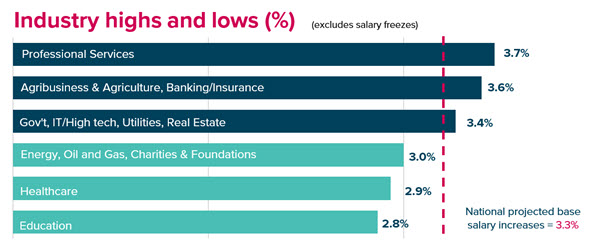

Highlights by industry:

Projected base salary increases range from 2.9% to 3.7%:

- Top sectors: Professional services (3.7%); agribusiness/agriculture and banking/insurance (3.6%)

- Mid-range sectors: Government, IT/high tech, real estate, utilities, construction, retail, manufacturing, member associations, and transportation (3.2% – 3.4%)

- Lowest increases: Charities, foundations, and energy/oil and gas (3.0%); Education and healthcare (2.9%)

Foundation compensation practices and strategic enhancements are a priority for 2026

Canadian organizations are balancing foundational compensation practices with strategic enhancements.

Key priorities include:

- Participating in salary benchmark surveys (45%)

- Updating job descriptions (45%)

- Providing compensation training and resources for people leaders (34%)

- Enhancing total rewards to be more flexible and employee-centric (34%)

- Conducting pay equity analysis (32%)

Pay transparency and technology (HRIS, AI) are emerging as areas to watch.

1Definition: Your total base salary budget includes merit increases, cost-of-living increases, across-the-board increases, minimum wage adjustments, market adjustments, equity adjustments, off-cycle increases, etc. Exclude any promotional increases.

About the Survey

Eckler’s Compensation eplanning survey was conducted from July to August 2025, with responses from over 500 Canadian organizations across diverse sectors. It provides critical insights into salary trends, pay practices, and HR priorities.

About Eckler

Established in 1927, Eckler is one of the longest-established and most respected consulting and actuarial practices. Our expertise knows no boundaries. Our team of more than 400 employees, based in offices and remotely throughout Canada and the Caribbean, works seamlessly across jurisdictions to provide integrated service—no matter where you are. Our head office is located in Toronto, Ontario, and our Canadian operations reach from coast to coast with offices in Vancouver, Winnipeg, Montreal, Quebec City, Fredericton, and Halifax.

Eckler’s consultants bring unparalleled expertise to help you reward, manage and support your people.

Media contact

Nancy Lee Martin

nlmartin@eckler.ca