Helping younger workers balance today’s financial pressures with tomorrow’s retirement goals

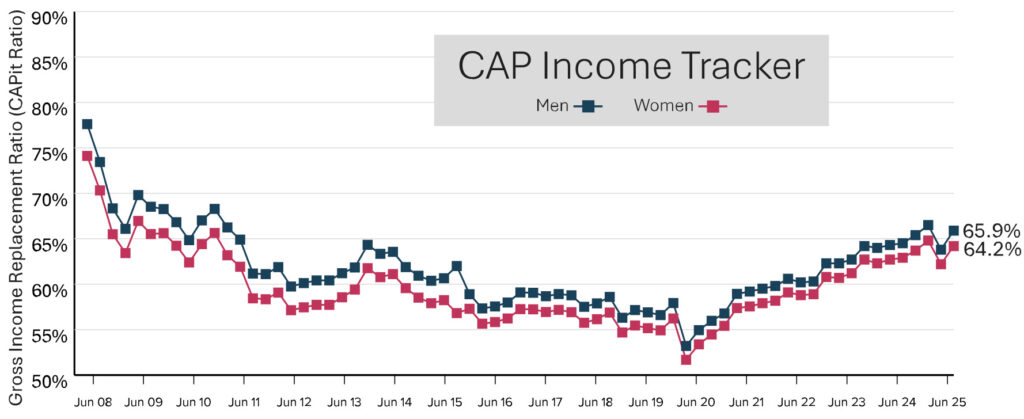

Capital Accumulation Plan Income Tracker (CAPit) – August 2025

Despite a sharp decline early in the quarter following President Trump’s announcement of the new “Liberation Day” trade tariffs, equity markets rebounded when tariffs were suspended for 90 days while trade talks progressed. This market rebound positively impacted Capital Accumulation Plan (CAP) members. A male member retiring at the end of June 2025 achieved a gross income replacement ratio of 65.9%, up from 63.8% in March 2025. A female member achieved 64.2%, up from 62.2%.

Engaging younger generations in financial wellness

Younger workers today face significant financial pressures. Between rising student debt, housing affordability challenges, and the escalating cost of living, it’s no surprise that many Gen Z and Millennial employees struggle to make the leap between the financial priorities of today and the future realities of retirement.

When day-to-day financial stress is front and center, putting money aside for the future can feel unrealistic so traditional retirement messaging may not connect. Many young employees are simply not engaging in workplace retirement plans either because they feel financially unable to contribute or because retirement feels irrelevant to their current stage of life. However, helping employees address their future financial needs today is critical to a financially secure retirement.

One way to connect is through more flexible plan designs. Increasingly, employers are introducing programs that give employees the ability to prioritize both short and long-term goals, allowing contributions to be directed into RRSPs, TFSAs, FHSAs or toward student debt depending on individual needs. This flexibility helps employees tackle financial goals like building emergency savings, paying off debt or saving for a first home, while still participating in retirement savings plans in a way that feels manageable and relevant.

Financial wellness tools and education also play a critical role. Many young workers are not sure where to start when it comes to budgeting, investing, or debt repayment. Offering access to financial planning resources, calculators, and interactive tools can help employees visualize their financial picture and make more informed decisions. Seeing how small contributions today grow over time, even while managing debt, is a powerful motivator.

Workshops or webinars tailored to younger demographics on topics like managing student loans, buying a home, or saving while renting, can also build financial literacy and confidence. Framing retirement not as an isolated goal but as part of a broader financial wellness journey, makes it feel more achievable.

When employees feel supported in both their immediate financial needs and their future goals, they are more likely to participate in retirement plans earlier and more consistently – which leads to better financial outcomes today and for the future.

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at age 40, will receive maximum Old Age Security and Canada/ Quebec Pension Plan payments, and will use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $77,624 at June 30, 2025.

This issue of CAPit has been prepared for general information purposes only and does not constitute professional advice. Should you require professional advice based on the contents of this publication, please contact an Eckler consultant.