Artificial intelligence on the investment landscape

Industries and sectors around the globe are embracing and investing in Artificial Intelligence (AI) like never before. It is reshaping how we work, create, and interact. For institutional investors and pension sponsors, it represents both an operational tool and an investment theme–impacting productivity, decision-making, and long-term portfolio value.

AI presents a complex but critical landscape for institutional investors. As adoption increases, understanding where capital is flowing, the regulatory environment, and which sectors are best positioned to benefit will be key to capturing value, while also managing legal, ethical, and operational risks.

Low volatility equities have long been positioned as a way to smooth the ride — particularly during market drawdowns. In 2025, they lived up to that promise, offering a buffer against tariff-driven market turbulence.

Robust investment and mixed regulatory progress

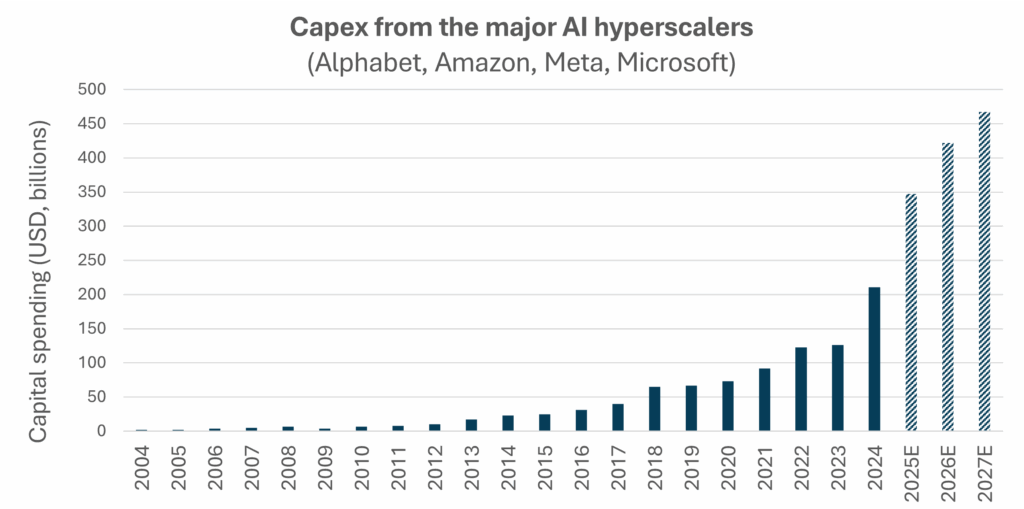

In April 2024, the Canadian federal government committed C$2.4 billion to support the AI sector including infrastructure, adoption for small and medium-sized businesses, start ups, and workforce reskilling. U.S. tech giants like Alphabet, Amazon, Meta, Microsoft, and Nvidia are investing heavily in semiconductor chips, data centers, and systems to support AI workloads. Venture capital is also fueling rapid AI startup growth.

Source: JP Morgan Guide to the Markets. Data as of September 30, 2025. All figures in $USD unless otherwise noted.

However, while capital investment has been robust, regulatory progress has been mixed. Canada, the first country to launch a national AI strategy in 2017, has since slipped in global AI rankings and the proposed Artificial Intelligence and Data Act (AIDA) failed to pass.

Globally, regulatory approaches are diverging. The EU AI Act (2024) enforces strict, risk-based rules, including bans on high-risk applications. In contrast, in early 2025 President Trump issued an Executive Order which promotes industry-led oversight and deregulation. Without clear legislation, Canada risks falling behind on both innovation and public trust. Currently, only 34% of Canadians trust AI, well below the global average1.

AI in institutional portfolios

AI exposure in institutional portfolios goes far beyond the well-known public tech giants. As AI reshapes industries, it presents opportunities for institutional investors to gain exposure across public equities, real assets, and private markets. Opportunities also exist across the broader ecosystem including infrastructure providers that power AI workloads, data centre operators, and private companies like emerging AI startups.

Within public equities, several of the largest companies in the world are developing AI products or enabling AI deployment. NVIDIA, which hit US$5 trillion in October 2025, is the largest company in the world by market capitalization and the first public company in the world to reach the milestone. NVIDIA stock has risen over 1,000% over the past 5 years, driven by demand for its AI chips. Other top firms involved in AI include Microsoft, Apple, Amazon, Meta, Broadcom, Alphabet, Tesla and Taiwan Semiconductor.

In real assets, AI workloads are driving demand for high-density, energy-intensive environments. The Canadian data centre market is projected to grow from $754.6 million in 2023 to $9.04 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 10.26%2. Hyperscalers like Amazon and Google (Alphabet) are also investing in small modular reactor (SMR) research and are exploring nuclear as a long-term clean energy source for their hyperscale data centres.

In private markets, capital continues to flow into AI startups. OpenAI, for example, raised $57.9 billion across 11 funding rounds. In March 2025, a $40 billion in Series F funding led by SoftBank stands as the largest private tech raise in history. As of October 2025, a private stock sale valued OpenAI at US$500 billion, making it the world’s most valuable private company. OpenAI investors include Microsoft, venture capital firm Andreessen Horowitz, and several sovereign wealth funds. Another major player, Databricks, a data and AI company that helps businesses process large amounts of data and build AI models, raised $10 billion in equity at a $62 billion valuation.

The need for a balanced and disciplined approach

Despite the enthusiasm and promising long-term portfolio value, while AI can present opportunities, it also comes with risks. A diligent and balanced approach to portfolio construction can help mitigate those risks. The list below highlights some of the most important considerations when evaluating AI-related investments.

Valuation risk remains front and center. Many AI-related companies trade at elevated multiples, driven by investor enthusiasm and high growth expectations, and the dominance of a few major players. As with previous tech cycles, stretched valuations can increase downside risk in market corrections.

Competition risk arises from the rapidly evolving AI landscape where there are many new entrants and emerging technologies. The fast-moving nature of AI makes it difficult to identify long-term winners. As an example, the launch of DeepSeek, a low-cost, high-performing Chinese model, disrupted market sentiment and shows how quickly leadership can change.

Market cycle risk highlights the importance of timing. Returns depend not only on choosing the right companies but also entering at the right stage in the hype cycle. Market corrections can be sharp for overvalued tech sectors, and AI is no exception. Macroeconomic conditions such as proposed tariffs can also overshadow long-term AI fundamentals in the short term.

Profitability risk reflects that technological proficiency does not necessarily guarantee value creation for investors. Not every company integrating AI into its business model will generate profits or build a durable competitive advantage. Business models must prove they can monetize AI over time.

Execution risk is especially relevant in regulated sectors like finance. AI implementation can be complex, requiring significant changes to infrastructure, operations, or compliance. Companies might run into unexpected technical challenges, need to redesign parts of their operations, or even shift strategy entirely.

AI is a promising long-term theme, but not every opportunity will translate into strong returns. High valuations, unclear profitability, and a fast-moving competitive environment make this a difficult space to navigate. As with past cycles, even companies with strong technology can underperform if entered at the wrong time or price. For institutional investors, a disciplined approach grounded in fundamentals – not headlines – will be key to separating long-term value from short-term hype.

AI is beginning to transform how pension funds operate and is being integrated across the entire value chain. These changes, while still evolving, are important to monitor. Institutional investors should focus on capturing diverse investment opportunities while ensuring responsible adoption within operations. As usage increases, integrating AI into strategy and operations will take both curiosity and caution. Asking the right questions now will be key. Early engagement will help build portfolios ready for the future.

At Eckler, we continue to evaluate and implement AI tools that uphold our high standards for security, privacy, and operational efficiency. As this technology advances, Eckler can help support institutional investors in navigating the evolving landscape.

- Trust, Attitudes and Use of Artificial Intelligence: A Global Study 2025, KPMG International & University of Melbourne.

- ENCOR Advisors, The State of Data Centres in Canada.